What Are Your Cash Cows?

You can now enjoy our content in audio format!

Need resources to expand?

Can’t expand without more resources?

You need a cash cow.

If you’re thinking about what to focus on in 2022 to increase revenue, there’s two important questions you should be asking.

1. What new service areas can you offer to your existing clients?

2. What is the untapped upside of the services you're already selling?

New Service vs. Cash Cow

New services are often a big blue ocean for you, because you can sell them to all of your clients. The downside is that you’ll probably spend a fair amount of time researching in order to find that new product or service, and then even more time figuring out how to sell it. The upside is obvious, but comes with a fair amount of downside as well. Find the right one and you’ve got a new superstar product. But getting to that point could be a long and winding road, filled with potholes. If you don’t have the resources to find the next superstar product right now, you might need to find yourself a cash cow.

We're not talking about cows because we're from Alberta, either. This is from the Boston Consulting Group matrix.

A cash cow is basically expanding on existing services and can be a rather fruitful endeavor. The biggest cash cows are the ones where you can expand your revenue without expanding your work too much – precisely the tonic for smaller shops that don’t have a lot of resources. Milking a cash cow can actually provide you with the revenue you need to increase your resources – a way to break out of the trap of needing to invest resources in order to expand, but not having resources without expanding.

How do you identify a cash cow?

There’s a couple of key bits of information you need. The first is you need to find a high margin product or service that you already sell and understand. You have the vendor relationship, and you’ve closed that sale before, which means you also have existed clients who can vouch for that particular offering.

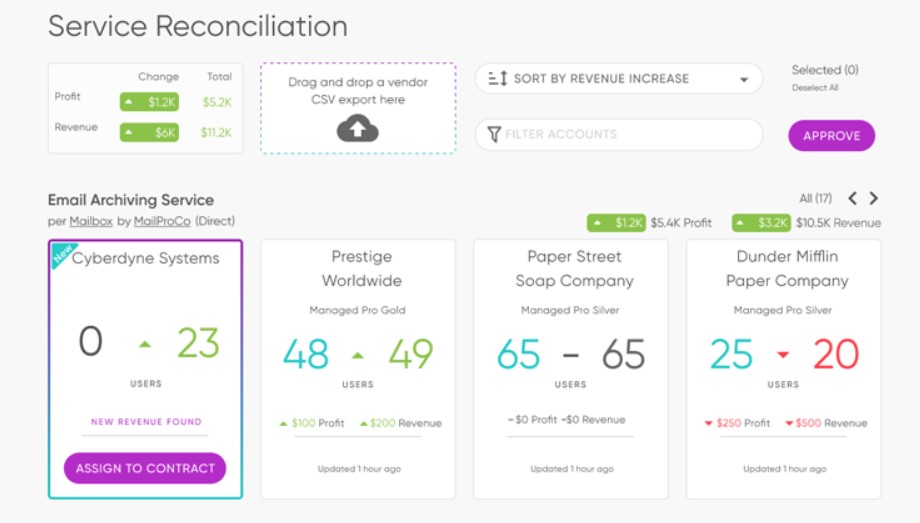

If you’re not already tracking what products provide the best gross margin, there’s this neat little billing reconciliation solution that can shed that light for you. Check out the service reconciliation screen in Billable™.

Here you can see that we’ve surfaced a few things. You’ve got revenue opportunities from licenses you’re already paying for but not yet billing for. From there, it’s easy to see the gross margin. Prestige Worldwide carries a 50% gross margin, for example.

Determining True Profitability

If your PSA gives you data on time spent servicing each offering, you can do some activity based costing on that service to derive its true profitability. If you do this for that service across clients, that will give you a pretty clear picture of the net margin on that service.

Your cash cows are the services with high net margin. The cash cows you are most interested in are the ones with high net margin but low penetration across your client base. Those should be quick wins that generate strong bottom line impacts.

Determine Upside Potential

If you want to take this train of thought further, figure out what the upside potential is. Knowing that you have something that is highly profitable even after taking into account the effort you put into servicing that product is the starting point here. If you realize that you can sell that service to the rest of your clients, for another 2000 seats, that helps you put a dollar figure on what you have left on the table. There might be some services that look like cash cows, but for one reason or another (such a vertical) you can't sell to your other clients.

Now you know which udders to pull, and on which cash cows.

The Bottom Line

The TL;DR on this is when you understand the net margin for each service you provide, you can identify which of your existing services has the biggest upside profit potential across your business for 2022.

Milk that cash cow, and you’ll have more financial resources to invest in other opportunities, like building out your marketing engine, hiring a star closer, or investigating new service options.

Let's take the hassle out of reconciling your vendor usage each month.

Want to learn more how Gradient ensures yours PSA contracts always reflect accurate vendor counts for monthly billing?

Book a meeting